rsu tax rate calculator

Apply more accurate rates to sales tax returns. Quickly learn licenses that your business needs and.

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Vesting after Social Security max.

. Massachusetts income tax rate. The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide. Vesting after Medicare Surtax max.

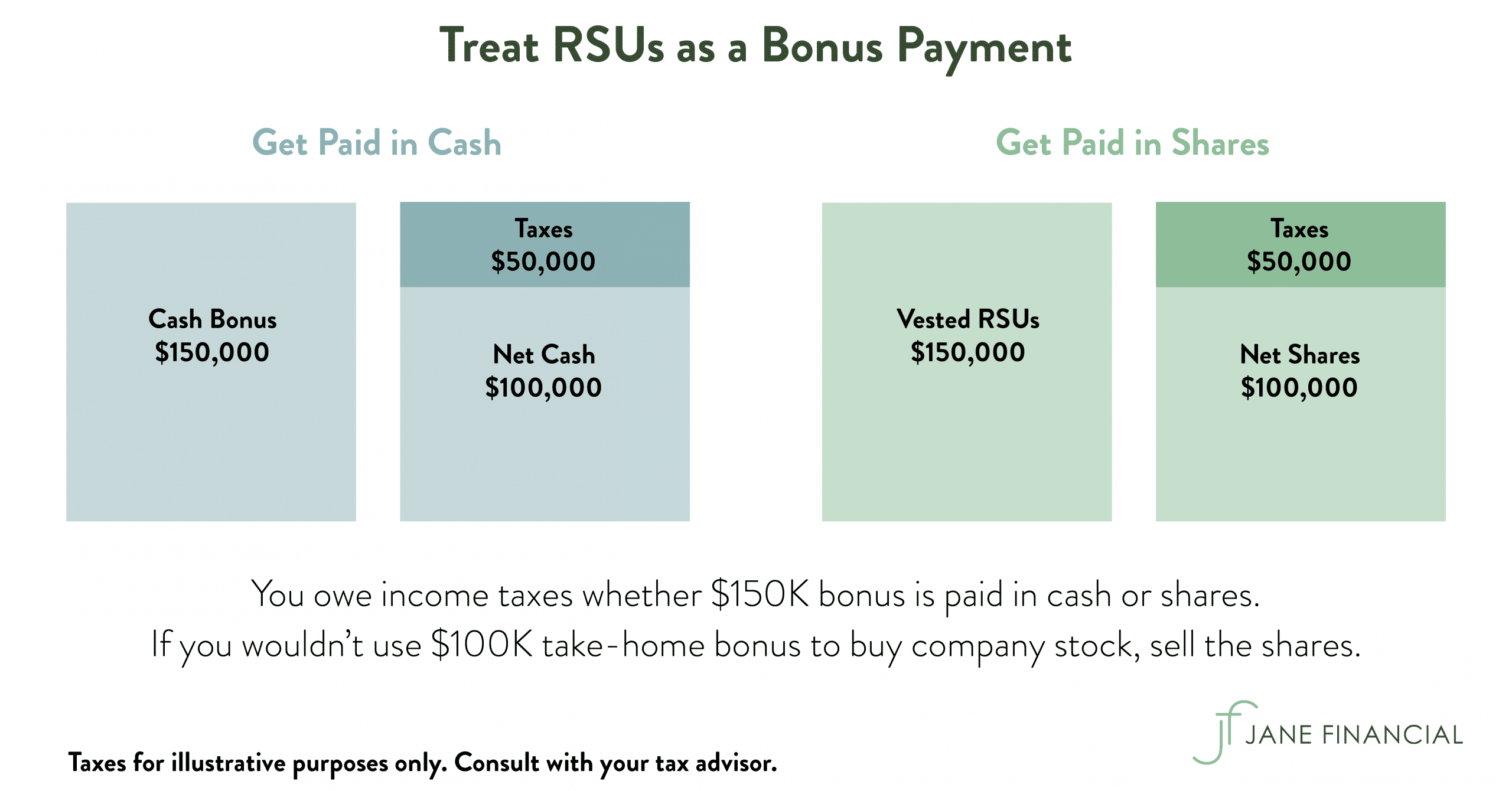

If you live in a state where you need to pay state. Here is an article on rsu tax. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

Restricted Stock Units RSUs Tax Calculator. The Massachusetts Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and. The of shares vesting x price of shares Income taxed in the current year.

Unless the RSU fits within an exception an employee pays tax on an RSU when he receives a unit the right to receive cash or shares as compensation. Restricted stock units rsus tax calculator apr 23 2019 0 hope you had a chance to glance over at the official restricted stock unit rsu strategy. RSU Taxes - A tech employees guide to tax on restricted stock units.

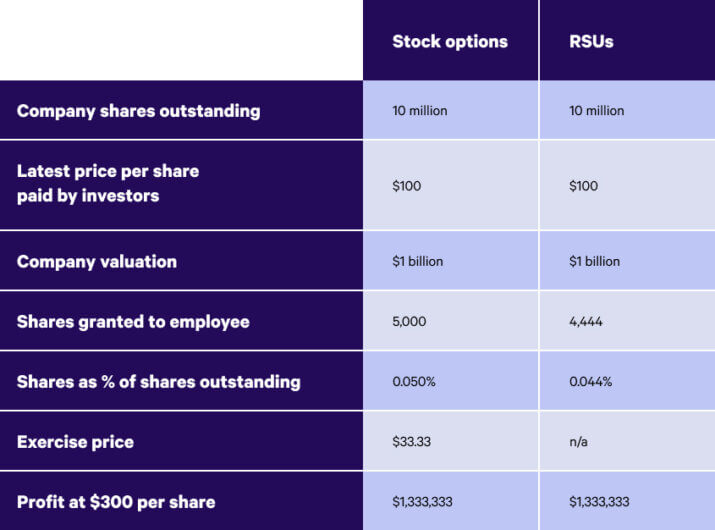

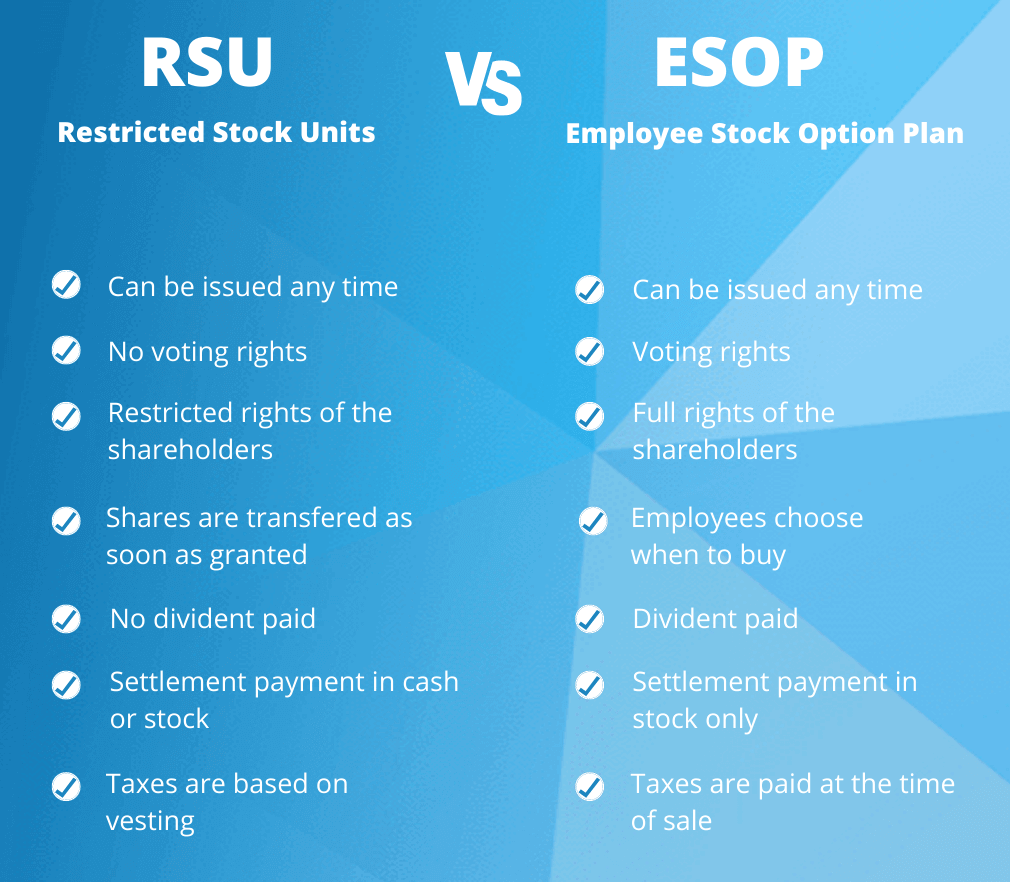

Many employees receive restricted stock units RSUs as a part of. This is different from incentive stock. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs.

If held beyond the vesting date the RSU tax when shares. To use the RSU projection calculator walk through the following steps. Choose your province or territory below to see the combined.

Vesting after making over. Enter the amount of your new grant whether an offer grant or an annual refresh. The Massachusetts income tax rate.

Tax Implications of Restricted Stock Units Ryan McInnis Date. If you arent sure how much to withhold use our paycheck calculator to find your tax liability. RSU tax at vesting date is.

Vesting after making over 137700. How Are Restricted Stock Units RSUs Taxed. This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and existing tax.

Clients have until Sept. How to Calculate Quarterly Estimated Taxes for 2021-2022. The of shares vesting x price of shares Income taxed in the current year.

Carol Nachbaur April 29 2022. Get information about sales tax and how it impacts your existing business processes. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest.

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

Tax Season 2022 What You Must Know About New Reporting Rules Mystockoptions Com

Restricted Stock Units Jane Financial

Are Rsus Taxed Twice Rent The Mortgage

Rsu Taxes Explained 4 Tax Strategies For 2022

Please Login Mystockoptions Com

Modelling Rsu Expense In Excel Financetrainingcourse Com

Rsu Sell To Cover Tax Tricks Explained Candor

Restricted Stock Units Jane Financial

Tax Time Making Sense Of Form W 2 When You Have Stock Compensation

Tax Calculator Estimate Your Income Tax For 2022 Free

Rsu Calculator Projecting Your Grant S Future Value

A Guide To Restricted Stock Units Rsus And Divorce

Rsu Calculator On The App Store

Restricted Stock Units Jane Financial

Explaining Rsus Or Restricted Stock Units Eqvista

Year End Planning For Stock Options Restricted Stock And Espps 6 Items For Your Checklist